Indonesia's Largest of Solar Farm: Key Opportunities and Challenges

Uploaded by Prakarsa Jaringan Cerdas Indonesia | 9 Maret 2021 Script Writer : Miftahus Salam

Editor : Nisma Islami Maharani & Cecilia Novia

Indonesia is comitted to achieve of 23% Renewable Energy in 2025's National Energy Mix as part of to fulfill the National Energy Policy Target and Paris Agreement. One of renewable energy resources is solar energy. Solar energy has biggest potential of renewable energy. It has 207,8 GW potential to be produced. But in 2021 the solar energy that has been installed is only 153.8 MWp (0,07%). To maximize the production and realize the Indoesia's Largest of Solar Farm we need to know the key opportunities and challenges to implementthe solar farm.

In 2020, the solar power has capacity of 153.8 MWp. In 2021 there is a plan to incerase capacity planning of 328.7 MW. The addition of this capacity is one proof of government commitment toward energy transition.

In terms of Solar Power development in Indonesia, there are 3 trends that will be entering the electricity system, namely Rooftop Solar PV, Large Scale Solar PV (Solar Farm), and Floating Solar PV.

Indonesia is a tropical country with large land to implement solar farm. There are three reasons that Indonesia has potential to generate electricity with solar energy

Has huge energy potential from solar energy

Indonesia is a tropical country with year-round sunshine. It makes Indonesia and ideal country for the implementation of large solar farm. Indonesia has 207,8 GW potential from solar energy.

Have large areas to install solar farm

Indonesia has large land and sea. To install enough PVs to meet the 2050 target, Indonesia needs at least 8,000 square kilometres, or about 0.4% of the country’s land area. Should problems with land acquisitions arise, the government could also install the solar panels on water. A large fraction of these panels can be placed on floats on lakes and sheltered seas. Indonesia has huge water territory as the world’s largest archipelago. It has lakes with an area of about 119,000km² and territorial sea of about 290,000km². Additionally, most buildings can host solar panels on the roof. [1]

Decreasing cost of solar farm installation

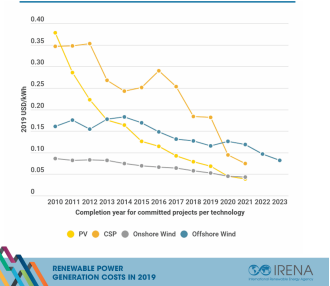

Along with the development of technology, implementation prices and generation rates from solar energy continue to decline every year. This can be seen in the graph of IRENA as follows.

Costs continue to fall for solar and wind power technologies

With that reason, Indonesia have opportunity to build large solar farm and generate green energy to PLN Grid and reach the target of RUEN and Paris Agreement,

But as usual where there are opportunities there are also challenges.

There are 4 key challenges of renewable implementation, i.e. :

Market Domination

Indonesia is not yet a producer country of renewable technologies. its implementation is still influenced by the dominance of other countries' markets

Political Will

Political will influence many sector in Indonesia. Without political will there won't be single project of renewable energy. This is because the energy sector is a sector that many people have interest in there.

Infrastructure and Technology

Without suitable infrastructure and technology to support renewable implementation, we need to improve a lot of things before we implement the renewable. This makes increase in the project cost

Investation

Funding is the most important thing to implement renewable energy. Without it, we can't afford the technology, the labor, and etc. This makes the project unable to start

Renewable Energy Landscape In Indonesia

Solid Underlying Fundamentals

Strong GDP growth rate (aside from current Covid-19 impact)

Demand for power typically outstrips GDP growth rate by a factor of 1.2 - 1.5x

Full electrification of the country not yet achieved, resulting in untapped demand

Geography / topography conducive to local solutions based on renewable energy / mini- or micro-grids

Still a heavy reliance on fossil fuels

Share of coal in the energy mix is high / will increase as a result of large coal-fired power stations under construction (based on RUPTL 2019: PLTU Java-3, PLTU Java-9 and Java-10, etc)

Coal contributed 58% of electricity generation in 2018, with growth rate of 8.8% (vs 6.0% total generation growth) from 2007 to 2017 [2]

Made up 66% of the total increase in power output in 2018 [2]

Low penetration rate for renewable energy (solar, wind, hydro)

Government Regulation No. 79 of 2014: New and renewable energy mix target is at least 23% by 2025 and 31% by 2050

12% of electricity generation in 2019, which should have been 17.5% according to the stipulated Regulation [3]

Gas is not a major fuel as of yet – but could become a transition fuel over time

Gas contributed 22% of electricity generation in 2018, with growth rate of 7.0% (vs 5.0% total generation growth) in 2018 [2]

Not all renewables are created equal

Tremendous, world-class hydro and geothermal resources

Solar starting form a low base but growth is expected to accelerate

Wind resource highly uneven and typically concentrated in some parts of the country (Sulawesi)

Key Investment Consideration

Regulatory framework:

Stable, transparent and permanent regulatory framework

Clearly articulated energy policy

Revenue certainty and quality of the revenue agreement

Rigorous risk allocation and de-risking of projects:

Early stage risks such land acquisition, ascertaining resources (geothermal, hydro), permitting

Successful partnerships to optimize risk mitigation (eg. partnerships with PJB)

Adequate construction risk mitigation

Efficient financing:

Optimized cost of capital (both debt and equity), particularly in bid situations

Stable capital structures reflecting the long-term nature of the assets

Current disruptions in the financing markets to abate

Covid 19 Impact on the Sector

Short term considerations

Equipment supply and construction disruptions

Liquidity in the capital structure to face increased risks for delays, increased costs

Sunset dates and deadlines under key commercial contracts

Force Majeure considerations

Longer term considerations

Delays in tenders / in awarding projects could set the industry back and jeopardize 2021/2022 installations

How will demand for power be affected in the longer run, and how will it impact PLN’s investment strategy?

Impact on financing sources

Availability of capital remains strong for green energy projects – lower for commodity-based projects or unloved asset classes

Cost of financing is increasing in the short term – however arguably a secondary consideration for long term assets such as power projects

Financing structures will include renewed focus on contingencies, delay and cost overrun risks, and quality of sponsor

To learn more, we can look at the lessons learned and best practice from Koppal Karnataka Solar Park Project, India

Best Practices

All the approvals/permits related to land and connectivity should be in the tender organizer scope

All the approvals/permits/management of common facilities in the solar park like pooling SS, transmission lines from SS till grid SS, roads, lights, water for modules cleaning, drainage system, etc. should be in the tender organizer scope

The tender organizer should provide: soil and geotechnical studies, hydro study

The tender organizer should install several pyranometers one year in advance on the site in order to have a good and representative irradiation of the site and share the raw data to the developers

The tender organizer should organize site visits

The tender organizer should charge a fee to the developers related to all the costs/work above but at nominal value or with a small margin to optimize the tariffs

Lesson Learned

The more the development risks are in the tender organizer scope, the more the developers will be aggressive

In case a fee related to all the development work is too high compared to the real cost, then it leads to high tariffs also. For Indonesia, this includes the current local content requirements on PV.

Visit us :

Freely register as PJCI member, click here: pjci.idremember.com www.smartgridindonesia.com

Comentários